Credit unions across the United States offer financial services focused on member benefits rather than profits. Among them, a few stand out for their size, membership reach, and strong asset portfolios. This list highlights some of the largest credit unions, each with unique histories, impressive asset sizes, and a commitment to serving specific communities. With billions in assets and extensive member services, these credit unions make a powerful impact. Let’s dive into what makes each of these credit unions a major player in U.S. banking.

Navy Federal Credit Union

Navy Federal Credit Union is the largest credit union in the U.S., with a substantial $156.6 billion in assets as of 2023. It was founded in 1933 in Vienna, Virginia, to serve Navy Department employees and has since expanded its membership to include all Department of Defense personnel, veterans, and their families. Dietrich Kuhlmann, a U.S. Navy veteran with decades of experience, took over as CEO in 2024, succeeding Mary McDuffie. Navy Federal now serves over 12 million members, providing an extensive range of financial services that include checking accounts, credit cards, and home loans. Its large network of branches and ATMs ensures convenient access to services worldwide. Navy Federal’s size, assets, and military-focused mission keep it at the forefront of the U.S. credit union landscape.

State Employees’ Credit Union (SECU)

State Employees’ Credit Union, known as SECU, is based in Raleigh, North Carolina, and serves over 2.8 million members. Established in 1937, it primarily supports North Carolina’s state employees and their families, providing affordable financial products. With assets of about $52 billion, SECU is the second-largest credit union in the nation. Led by CEO Leigh Brady, SECU offers members a variety of services, from savings accounts to retirement planning options. Its community-focused initiatives, including scholarships and low-rate loans, reflect SECU’s commitment to public service. As a major financial entity in North Carolina, SECU plays a vital role in its local economy while remaining dedicated to its members.

Pentagon Federal Credit Union (PenFed)

Headquartered in McLean, Virginia, Pentagon Federal Credit Union, or PenFed, serves over 2 million members globally, including military, government employees, and their families. Founded in 1935, it has grown into one of the largest federal credit unions with assets exceeding $35 billion. Under the leadership of CEO James Schenck, PenFed offers a broad range of financial products, including mortgages, credit cards, and savings accounts. Known for competitive loan rates and extensive member benefits, PenFed prioritizes financial education and support for military families. Its outreach programs and partnerships reflect a mission rooted in service, making PenFed a respected institution among U.S. credit unions.

Golden 1 Credit Union

Golden 1 Credit Union, based in Sacramento, California, ranks among the largest credit unions in the state and the nation, with assets nearing $18 billion. Since its founding in 1933, Golden 1 has expanded its membership to over 1 million Californians, offering services such as home loans, checking accounts, and investment products. CEO Donna A. Bland leads the credit union, emphasizing community involvement and accessible financial services. Golden 1’s commitment to education and social programs is evident in its scholarships and community support initiatives. With a strong presence across California, Golden 1 remains a trusted financial resource for its members.

America First Credit Union

America First Credit Union, located in Riverdale, Utah, is among the country’s largest credit unions, with assets of over $17 billion. Founded in 1939, America First serves members across Utah, Nevada, Idaho, and Arizona, with a focus on affordable, quality financial products. Led by CEO John Lund, the credit union offers services that include auto loans, savings accounts, and credit cards. America First is known for its competitive rates and extensive member benefits, such as discounts and financial counseling. Its outreach programs and community involvement reflect a dedication to member satisfaction, making it a prominent credit union in the western U.S.

Alliant Credit Union

Alliant Credit Union, headquartered in Chicago, Illinois, serves over 500,000 members nationwide. Originally established in 1935 as United Airlines Employees’ Credit Union, Alliant has grown significantly, boasting assets of approximately $14 billion. Under the leadership of CEO Dennis Devine, Alliant focuses on providing digital-first financial services, including high-interest savings accounts, loans, and insurance products. Known for its strong customer service and technology-driven approach, Alliant aims to deliver convenient, accessible financial solutions. It remains committed to competitive rates and member satisfaction, which has helped solidify its reputation in the credit union industry.

Mountain America Credit Union

Mountain America Credit Union, headquartered in Sandy, Utah, was founded in 1934 and has grown to serve nearly 1 million members across the western United States. With assets exceeding $13 billion, Mountain America offers a comprehensive array of financial products, from checking accounts to business loans. CEO Sterling Nielsen leads the credit union with a focus on innovation, member education, and financial wellness. Mountain America’s community outreach and charitable programs reflect a strong commitment to the regions it serves. Known for personalized service and competitive rates, Mountain America has established itself as a trusted financial partner for individuals and businesses alike.

Suncoast Credit Union

Suncoast Credit Union, headquartered in Tampa, Florida, is the largest credit union in the state, serving over 1 million members. Founded in 1934, Suncoast has grown to amass assets of approximately $16 billion. CEO Kevin Johnson leads the credit union, which offers a wide array of financial products, including checking accounts, loans, and credit cards. Suncoast is known for its commitment to education, supporting local schools and scholarships through its Suncoast Credit Union Foundation. It also provides comprehensive digital banking services, making access to financial tools easy and convenient for members across Florida.

Randolph-Brooks Federal Credit Union (RBFCU)

Randolph-Brooks Federal Credit Union, commonly known as RBFCU, is based in Live Oak, Texas, and serves over 1 million members. Established in 1952, RBFCU has grown significantly, with assets now exceeding $15 billion. Led by CEO Christopher O’Connor, the credit union offers financial services like personal loans, mortgages, and business accounts. Known for its member-first approach, RBFCU provides competitive rates and numerous member benefits, including financial education resources. The credit union is highly regarded for its focus on technology, offering robust online and mobile banking options to meet the needs of its Texas-based members.

VyStar Credit Union

VyStar Credit Union, headquartered in Jacksonville, Florida, ranks as one of the largest credit unions in the Southeast. Originally founded in 1952 to serve military personnel, VyStar has since opened its doors to communities across Florida and Georgia. With assets of over $13 billion, VyStar provides members with comprehensive financial products, from savings accounts to home loans. Brian Wolfburg, the CEO, oversees the institution’s focus on service, community involvement, and affordable banking options. VyStar is also known for its commitment to charitable causes, supporting various initiatives in education, health, and veteran services.

Lake Michigan Credit Union

Lake Michigan Credit Union, based in Grand Rapids, Michigan, is one of the largest and most trusted credit unions in the Midwest. Founded in 1933, it has expanded its membership and now holds assets of around $12 billion. Sandy Jelinski serves as the CEO, leading the credit union’s efforts to provide a wide range of services, including low-rate loans, checking accounts, and retirement planning. Lake Michigan Credit Union is especially known for its competitive mortgage products and community involvement. The credit union’s focus on both member benefits and regional impact has made it a prominent financial institution in Michigan and beyond.

Security Service Federal Credit Union

Security Service Federal Credit Union, headquartered in San Antonio, Texas, is known for its strong presence in Texas, Colorado, and Utah. Established in 1956, it now has over $10 billion in assets and serves over 800,000 members. Led by CEO Jim Laffoon, Security Service offers a wide range of financial products, including personal and auto loans, mortgages, and investment services. It is particularly recognized for its commitment to military members, with a long history of serving military communities. Security Service’s dedication to digital innovation and community support sets it apart in the credit union sector.

San Diego County Credit Union

San Diego County Credit Union, or SDCCU, is based in San Diego, California, and is one of the largest credit unions in the state. Founded in 1938, SDCCU serves over 400,000 members and manages assets of about $10 billion. Under the leadership of CEO Teresa Halleck Campbell, SDCCU offers a variety of financial services, including high-yield savings accounts, auto loans, and credit cards. The credit union has a strong commitment to its local community, supporting events and charitable organizations throughout Southern California. Its focus on personalized service and competitive products makes SDCCU a popular choice for Californians.

Bethpage Federal Credit Union

Bethpage Federal Credit Union, headquartered in Bethpage, New York, is one of the largest credit unions on the East Coast. Established in 1941, it has grown to serve over 400,000 members with assets totaling approximately $9 billion. Led by CEO Wayne Grossé, Bethpage provides a comprehensive suite of financial services, including mortgages, credit cards, and investment products. Known for its commitment to Long Island’s communities, Bethpage supports numerous local charities and community initiatives. The credit union’s dedication to affordable banking and community impact has solidified its role as a major financial institution in New York.

Digital Federal Credit Union (DCU)

Digital Federal Credit Union, or DCU, is headquartered in Marlborough, Massachusetts, and serves members nationwide. Founded in 1979, DCU has grown rapidly, now boasting assets of over $8 billion. Led by CEO Jim Regan, the credit union offers digital-first financial services, including personal loans, credit cards, and online banking. Known for its technology-driven approach, DCU provides innovative solutions to make banking easy and accessible for its members. DCU’s commitment to affordability and convenience, paired with a focus on financial education, has helped it become a trusted credit union across the U.S.

Global Federal Credit Union

Global Federal Credit Union, formerly known as Alaska USA Federal Credit Union, is headquartered in Anchorage, Alaska, with a significant member base across Alaska, Washington, and Arizona. Founded in 1948, it has grown to manage assets exceeding $8 billion and serves over 700,000 members. Led by CEO Geoff Lundfelt, Global FCU offers a range of services, from high-interest savings to home mortgages. It is known for its strong member support and focus on military families. Global FCU’s commitment to community development and financial security for its members makes it a key financial institution in multiple states.

Ent Credit Union

Ent Credit Union, headquartered in Colorado Springs, Colorado, is the largest credit union in Colorado. Founded in 1957, it now serves over 500,000 members and holds assets of approximately $7 billion. CEO Chad Graves leads the institution, which offers a variety of financial products, including competitive mortgage rates, personal loans, and investment options. Ent has a strong presence across Colorado, known for its community initiatives and financial education programs. Ent’s dedication to member satisfaction and regional impact has made it a prominent choice for Coloradans seeking reliable financial services.

This article originally appeared on Rarest.org.

More from Rarest.org

11 Famous Landmarks That Were Never Completed

Some of the world’s most famous landmarks stand not because of their completion, but because of their intriguing, unfinished states. Read More.

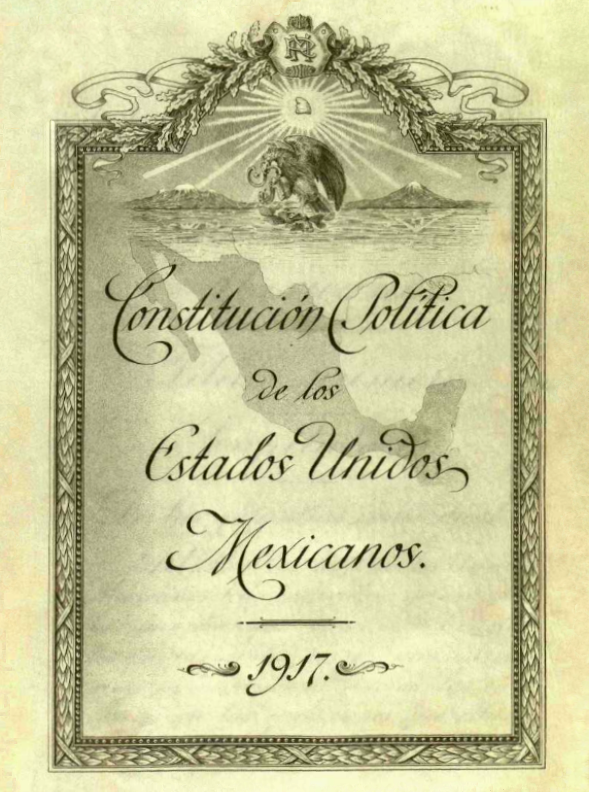

10 Oldest Constitutions In The World

A constitution is the fundamental legal document that defines the structure of a country’s government and outlines the rights of its citizens. Read More.

12 Endangered River Ecosystems Facing the Threat of Damming

Rivers around the world are under increasing threat from damming and other forms of water management, which are disrupting natural ecosystems and threatening the biodiversity that depends on these waterways. Read More.