Understanding the world’s most valuable currencies provides insight into the economic health, stability, and strategic importance of various nations. These currencies, backed by robust economies, abundant natural resources, and sound fiscal policies, hold significant value in global markets. From the Kuwaiti Dinar to the Qatari Riyal, each currency’s strength is a testament to the underlying economic strategies and geopolitical factors that bolster their worth.

Kuwaiti Dinar (KWD)

The Kuwaiti Dinar is the world’s highest-valued currency unit per face value. This small, oil-rich nation in the Persian Gulf pegs its currency to an undisclosed basket of currencies, ensuring stability and immense value. Kuwait’s vast oil reserves, political stability, and prudent economic management have fortified the strength of its dinar.

Bahraini Dinar (BHD)

Second only to the Kuwaiti Dinar, the Bahraini Dinar enjoys a high exchange rate due to Bahrain’s robust financial sector and significant petroleum production. The Bahraini government maintains a fixed exchange rate to the US dollar, enhancing investor confidence and economic predictability.

Omani Rial (OMR)

The Omani Rial’s substantial value can be attributed to the Sultanate’s prudent fiscal policies, extensive oil exports, and strategic location in the Middle East. Oman maintains a peg to the US dollar, providing stability and fostering economic growth.

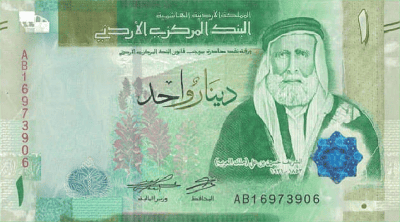

Jordanian Dinar (JOD)

Despite lacking significant natural resources, Jordan’s Dinar is highly valued, reflecting the country’s stable economy and strategic geopolitical importance. The currency is pegged to the US dollar, ensuring economic stability and attracting foreign investment.

British Pound Sterling (GBP)

The British Pound Sterling, one of the oldest and most traded currencies, holds significant value due to the UK’s strong economy, influential financial markets, and historical legacy. The pound’s value is supported by the UK’s robust legal system, political stability, and economic diversification.

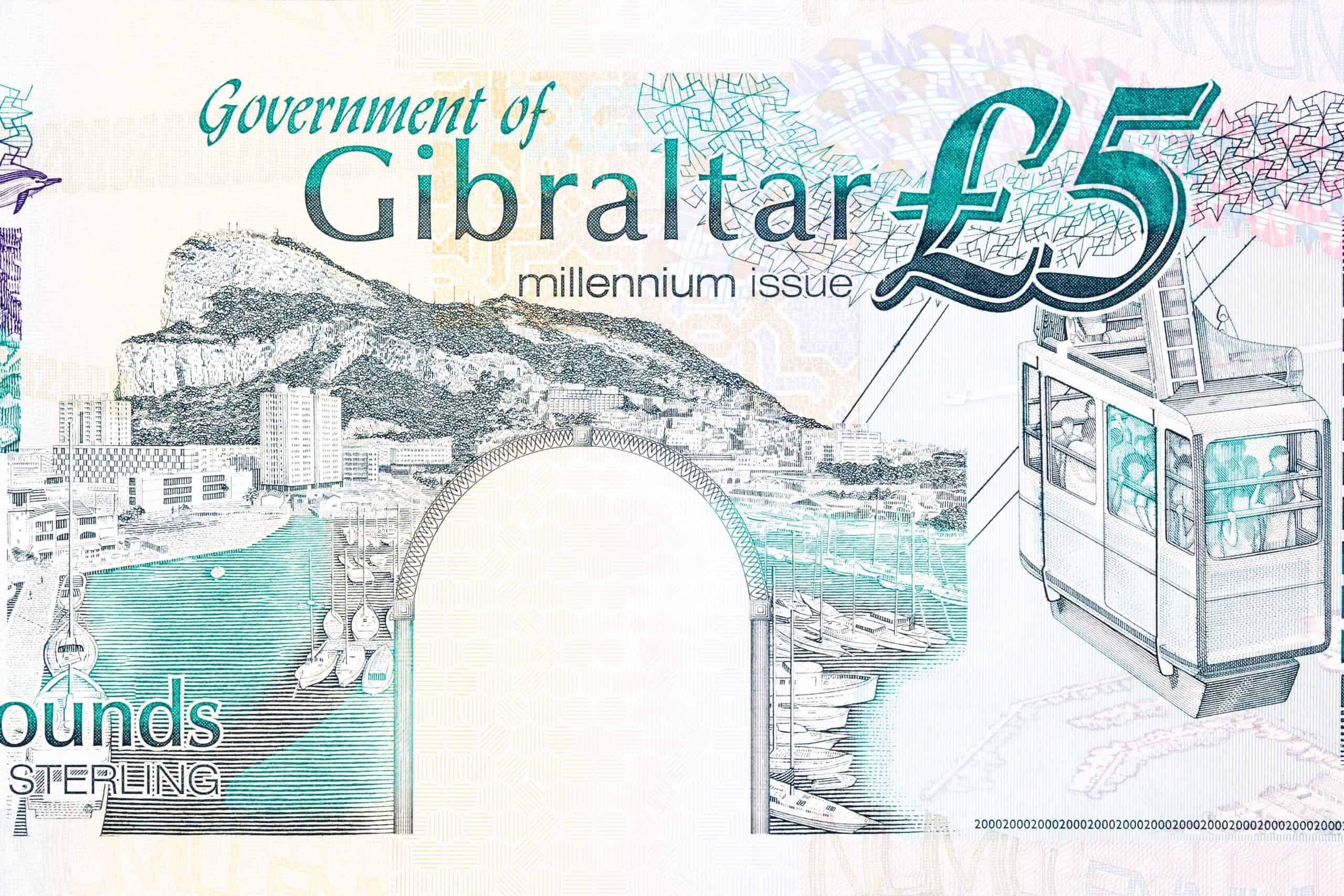

Gibraltar Pound (GIP)

Closely tied to the British Pound, the Gibraltar Pound benefits from Gibraltar’s strategic location, robust financial services, and tourism industry. The currency’s value is maintained through its fixed exchange rate with the British Pound.

Cayman Islands Dollar (KYD)

The Cayman Islands Dollar is highly valued due to the islands’ status as a leading offshore financial center, attracting vast international capital. The government maintains a fixed exchange rate with the US dollar, ensuring economic stability.

Euro (EUR)

The Euro, used by 19 of the 27 European Union countries, is one of the world’s most powerful currencies. Its value is driven by the collective economic strength of the Eurozone, significant global trade, and political cooperation among member states.

Swiss Franc (CHF)

Renowned for its stability, the Swiss Franc is highly valued due to Switzerland’s robust economy, political neutrality, and strong banking sector. Investors consider the Swiss Franc a safe-haven currency, especially during global economic uncertainties.

US Dollar (USD)

The US Dollar, the world’s primary reserve currency, holds immense value due to the United States’ economic might, political stability, and global influence. The dollar’s dominance in international trade and finance further cements its value.

Canadian Dollar (CAD)

The Canadian Dollar benefits from Canada’s abundant natural resources, stable economy, and strong trade relations with the US. Its value is influenced by global commodity prices, particularly oil and natural gas.

Australian Dollar (AUD)

Australia’s economic stability, rich natural resources, and strategic trade relationships contribute to the Australian Dollar’s high value. The currency is also a popular choice for carry trade, attracting global investors.

Singapore Dollar (SGD)

The Singapore Dollar is highly valued due to Singapore’s strategic location, robust economy, and status as a global financial hub. Prudent monetary policies and a strong fiscal position enhance the currency’s value.

Brunei Dollar (BND)

Brunei’s wealth, driven by extensive oil and gas reserves, underpins the high value of the Brunei Dollar. The currency is pegged to the Singapore Dollar, reflecting the close economic ties between the two nations.

Libyan Dinar (LYD)

Despite political challenges, the Libyan Dinar maintains a high exchange rate, primarily due to Libya’s significant oil reserves. The currency’s value is influenced by the country’s hydrocarbon wealth and economic potential.

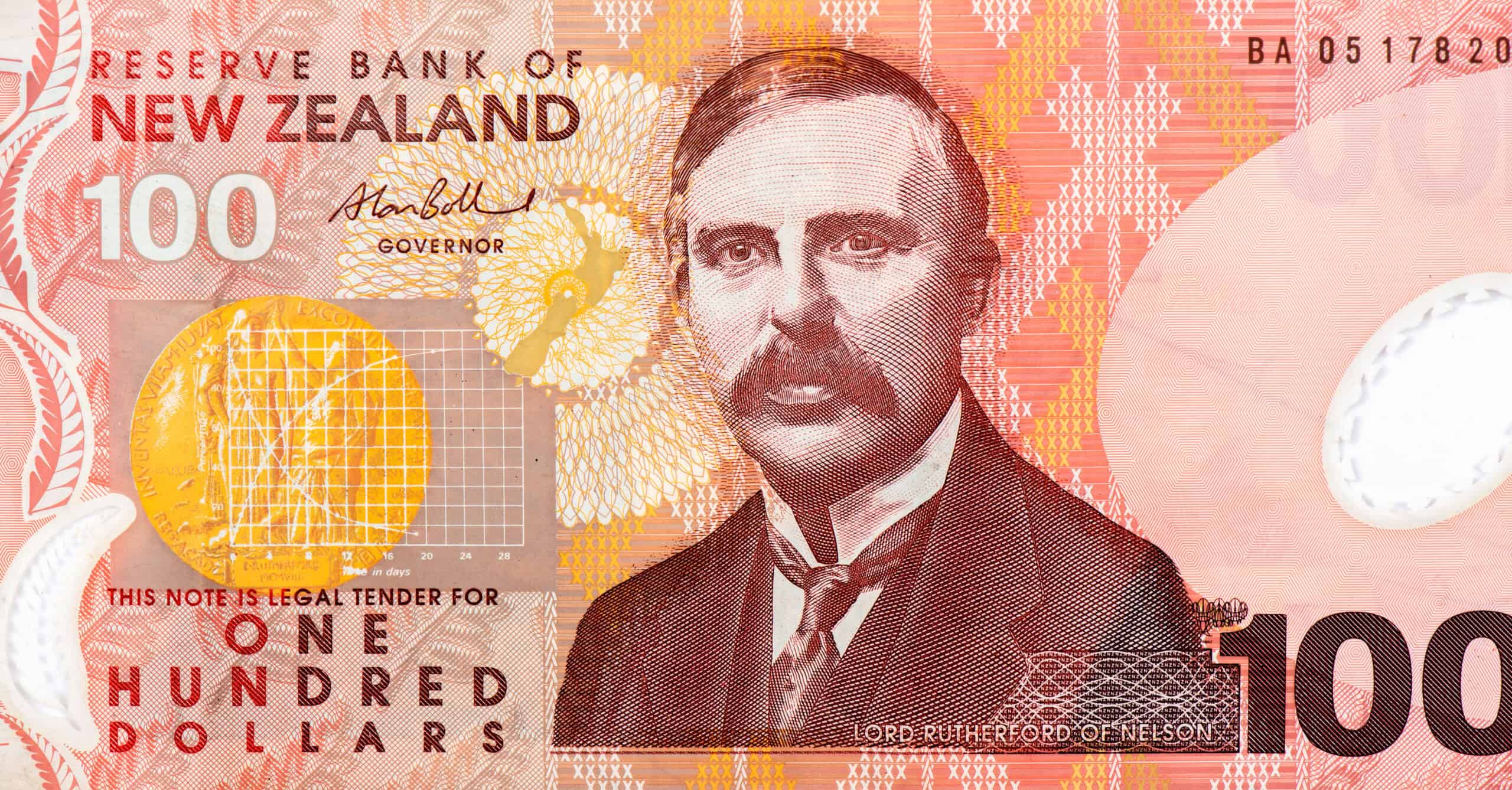

New Zealand Dollar (NZD)

New Zealand’s stable economy, diverse exports, and strong trade relationships contribute to the New Zealand Dollar’s value. The currency is also popular for its relatively high-interest rates compared to other developed nations.

Fijian Dollar (FJD)

The Fijian Dollar’s value is supported by Fiji’s thriving tourism industry, agricultural exports, and strategic location in the Pacific. The government maintains sound economic policies to ensure currency stability.

Bermudian Dollar (BMD)

The Bermudian Dollar is pegged to the US Dollar at a one-to-one ratio, benefiting from Bermuda’s strong financial sector and tourism industry. This fixed exchange rate enhances economic stability and investor confidence.

Bahamian Dollar (BSD)

Similar to the Bermudian Dollar, the Bahamian Dollar is pegged to the US Dollar, reflecting the Bahamas’ stable economy and thriving tourism sector. The currency’s value is bolstered by the country’s financial services industry.

Qatari Riyal (QAR)

The Qatari Riyal’s high value stems from Qatar’s vast natural gas reserves, substantial foreign investments, and strategic economic diversification efforts. The currency is pegged to the US dollar, ensuring economic predictability and stability.

This article originally appeared on Rarest.org.