In the realm of car insurance, costs can vary dramatically from state to state. Understanding these variations is crucial for anyone looking to get the best coverage without breaking the bank. Dive into our exploration of the most expensive car insurance by state to gain insights into these regional differences and how they might impact your insurance premiums.

1. Michigan

Image Editorial Credit: Hansol / Shutterstock

Image Editorial Credit: Hansol / Shutterstock

Historically, Michigan has had some of the highest car insurance rates in the United States, with costs typically ranging from $2,000 to $3,000 annually due to its unique no-fault insurance system and high medical costs for auto-related injuries.

2. Louisiana

Image Editorial Credit: Kevin Ruck / Shutterstock

Image Editorial Credit: Kevin Ruck / Shutterstock

The state experiences high car insurance rates, usually between $2,200 and $3,500 per year, due to its legal system that encourages lawsuits, high rates of uninsured motorists, and frequent natural disasters like hurricanes.

3. Florida

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Florida’s insurance costs are elevated, ranging from $1,800 to $3,000 annually, due to its high number of uninsured drivers, its no-fault insurance system, and the risk of natural disasters such as hurricanes and floods.

4. New York

Image Editorial Credit: shutterupeire / Shutterstock

Image Editorial Credit: shutterupeire / Shutterstock

Dense urban areas, particularly New York City, contribute to higher accident rates and insurance costs, with prices typically ranging from $1,700 to $2,900 per year, while the state’s no-fault insurance system leads to higher than average claims payouts.

5. Nevada

Image Editorial Credit: f11photo / Shutterstock

Image Editorial Credit: f11photo / Shutterstock

Nevada, particularly Las Vegas, has high insurance rates, typically between $1,600 and $2,500 annually, because of its above-average accident rates and the high cost of vehicle repairs in the state.

6. New Jersey

Image Editorial Credit: Mihai_Andritoiu / Shutterstock

Image Editorial Credit: Mihai_Andritoiu / Shutterstock

The state’s dense population and high cost of living contribute to its high insurance premiums, usually ranging from $1,800 to $2,800 per year, along with a high rate of accidents and expensive medical costs.

7. California

Image Editorial Credit: Sean Cavone / Shutterstock

Image Editorial Credit: Sean Cavone / Shutterstock

California’s high insurance rates are due to its dense population, high cost of vehicle repairs, and a legal environment conducive to lawsuits, typically ranging from $1,900 to $3,200 per year.

8. Pennsylvania

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Pennsylvania’s insurance costs are driven up by its no-fault insurance system and high medical benefit requirements, with prices typically ranging from $1,600 to $2,700 annually, increasing the overall cost of claims.

9. Rhode Island

Image Editorial Credit: leoks / Shutterstock

Image Editorial Credit: leoks / Shutterstock

This state has high insurance rates, usually ranging from $1,800 to $2,800 per year, due to its small size and high population density, leading to a greater likelihood of accidents and higher repair costs.

10. Delaware

Image Editorial Credit: LightInThisWorld / Shutterstock

Image Editorial Credit: LightInThisWorld / Shutterstock

Delaware’s high premiums are influenced by its high population density and the expensive cost of personal injury protection coverage required by the state, typically ranging from $1,700 to $2,600 annually.

11. Connecticut

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Connecticut typically experiences expensive insurance premiums, with costs ranging from $1,900 to $2,800 annually, due to the state’s affluent population, high vehicle repair costs, and a high frequency of costly claims.

12. Kentucky

Image Editorial Credit: Ivelin Denev / Shutterstock

Image Editorial Credit: Ivelin Denev / Shutterstock

Kentucky faces elevated insurance costs, usually between $1,600 and $2,500 per year, attributed to its no-fault insurance system and a high percentage of uninsured drivers.

13. Texas

Image Editorial Credit: Roschetzky Photography / Shutterstock

Image Editorial Credit: Roschetzky Photography / Shutterstock

Texas sees high car insurance rates, typically ranging from $1,800 to $3,000 annually, due to a large number of uninsured drivers and the risk of natural disasters, such as hurricanes and hailstorms, which can lead to higher claim frequencies.

14. Georgia

Image Editorial Credit: Janis Apels / Shutterstock

Image Editorial Credit: Janis Apels / Shutterstock

Georgia has high insurance rates, usually ranging from $1,700 to $2,900 per year, due to high traffic congestion in urban areas like Atlanta, along with a significant number of uninsured drivers.

15. Colorado

Image Editorial Credit: f11photo / Shutterstock

Image Editorial Credit: f11photo / Shutterstock

Colorado has experienced rising insurance costs, with prices typically ranging from $1,800 to $2,700 annually, due to an increase in natural disasters and the rising costs of vehicle repairs and healthcare.

16. Arizona

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Arizona faces higher insurance rates, typically ranging from $1,600 to $2,500 per year, affected by high repair costs and the dense population of cities like Phoenix, leading to more frequent accidents.

17. Washington

Image Editorial Credit: f11photo / Shutterstock

Image Editorial Credit: f11photo / Shutterstock

Washington incurs high car insurance premiums, usually ranging from $1,900 to $3,000 per year, because of the Seattle area’s dense population, high cost of living, and elevated repair expenses.

18. Maryland

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Maryland experiences elevated insurance costs, with prices typically ranging from $1,700 to $2,900 annually, due to high traffic density and a significant number of uninsured drivers.

19. Massachusetts

Image Editorial Credit: Sean Pavone / Shutterstock

Image Editorial Credit: Sean Pavone / Shutterstock

Massachusetts has high insurance costs, typically ranging from $1,800 to $2,800 per year, due to its no-fault insurance system and the high cost of medical services, which increase claim payouts.

20. Minnesota

Image Editorial Credit: EWY Media / Shutterstock

Image Editorial Credit: EWY Media / Shutterstock

Minnesota faces higher insurance costs, typically ranging from $1,700 to $2,900 per year, due to the state’s harsh winters and no-fault insurance system leading to higher accident rates and insurance costs, respectively.

This article is originally appeared on Rarest.org

More from Rarest.org

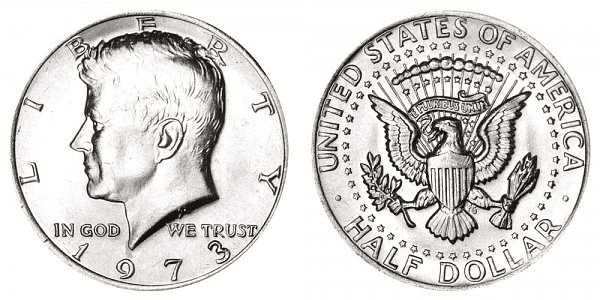

1973 Kennedy Half Dollar Value Guide

Provided by Rarest.org

The 1973 Kennedy half dollar is made of 75% copper and 25% nickel. The coin is clad with nickel, and its core is pure copper. However, the Kennedy half dollar was initially made of 60% copper and 40% silver, produced from 1965 to 1970. Read More

1934 Buffalo Nickel Value Guide

Provided by Rarest.org

The 1934 Buffalo nickel has a face value of $0.05 or five cents. It weighs 5.00 grams, has a metal composition of 75% Copper and 25% Nickel, and measures 21.20 millimeters in diameter. Read More

1943 Lincoln Steel Penny Value Guide

Provided by Rarest.org

The 1943 Lincoln steel penny is perhaps the most unique type of penny coin in the entire series of Lincoln penny. For one, it is the only year when the Lincoln penny was struck in steel. Read More

Image Editorial Credit:

Image Editorial Credit:

Image Editorial Credit:

Image Editorial Credit:

Image Editorial Credit:

Image Editorial Credit:  Image Editorial Credit:

Image Editorial Credit:  Image Editorial Credit:

Image Editorial Credit: